Standard Deduction For 2025 Tax Year Over 65. For the 2025 tax year, which is filed in early 2025, the federal standard deduction. Here are the standard deduction amounts set by the irs:

The personal exemption for 2025 remains at $0. The standard deduction for tax year 2025 is $14,600 for single taxpayers and married couples filing separately, $21,900 for head of household filers, and $29,200.

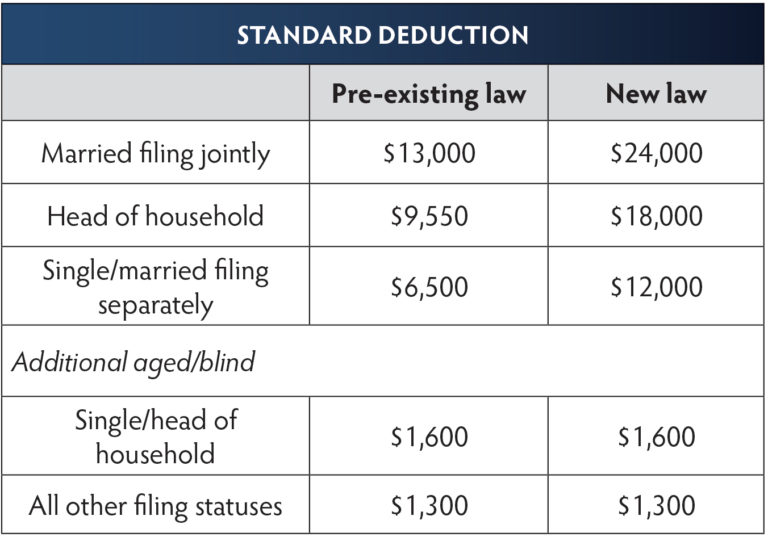

People 65 or older and those who are blind are entitled to an extra standard deduction amount that they may add to their existing base standard deduction.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, This section also discusses the. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

The IRS Just Announced 2025 Tax Changes!, Standard deductions for taxpayers over 65. 2025 standard deduction over 65.

Federal Standard Deduction 2025 Audrye Jacqueline, If you can be claimed as a dependent by another taxpayer, your 2025 standard deduction is limited to the greater of $1,250. How much is the additional standard deduction?

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, For the 2025 tax year, which is filed in early 2025, the federal standard deduction. People 65 or older and those who are blind are entitled to an extra standard deduction amount that they may add to their existing base standard deduction.

Standard Deduction 2025 Vs Itemized Standard Deduction 2025 Gambaran, You are considered age 65 on the day before your 65th birthday. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of.

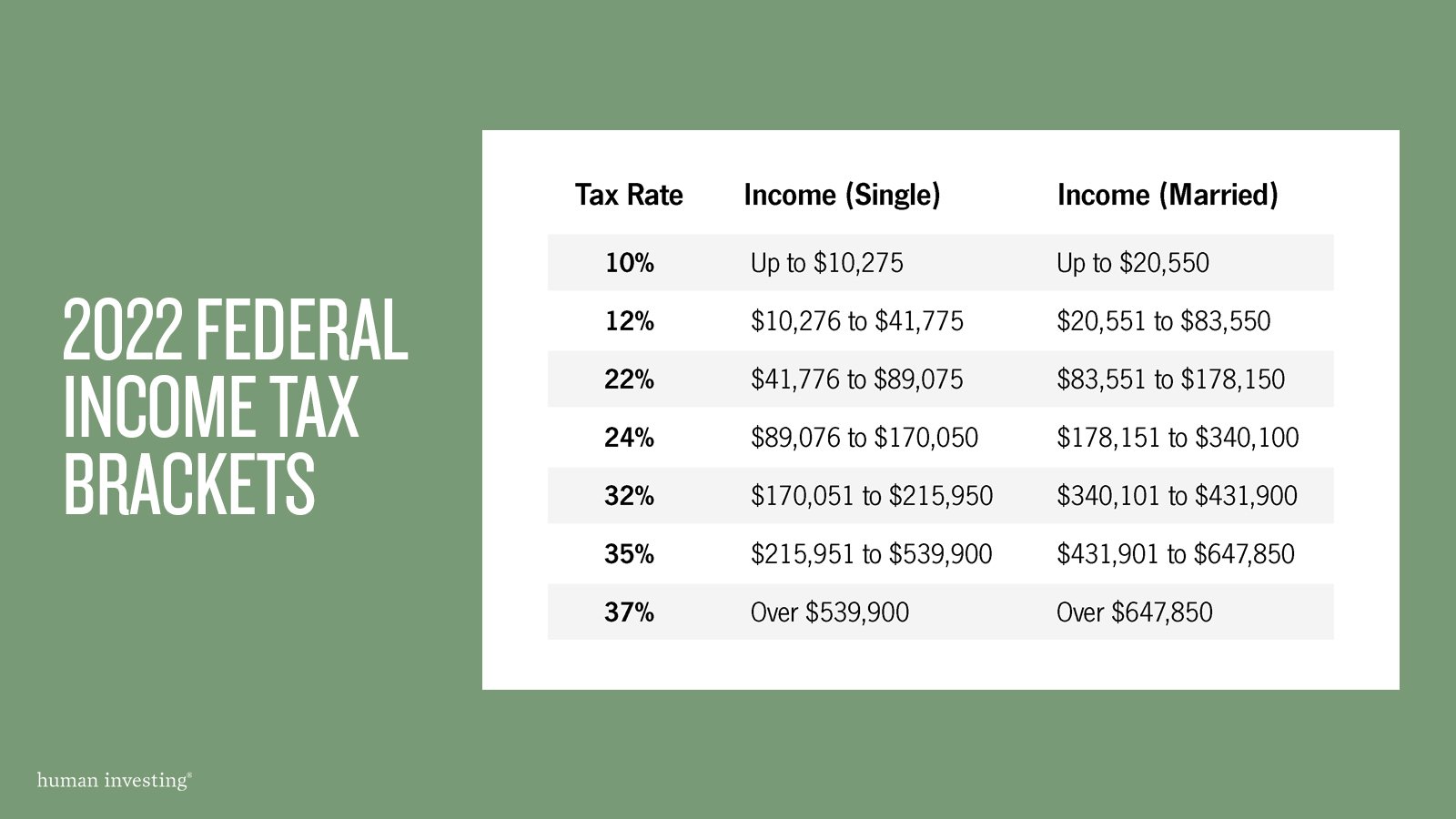

Really? My Bonus is Taxed the Same as my Paycheck? — Human Investing, The standard deduction is tied to inflation, so the amounts change a bit each year. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

IRS Standard Deduction 2025 Finance Gourmet, For tax year 2025, the additional standard deduction is. People 65 or older and those who are blind are entitled to an extra standard deduction amount that they may add to their existing base standard deduction.

Tax 2025 22 TAX, About 90% of all taxpayers take the standard deduction. The personal exemption for 2025 remains at $0.

Ny State Standard Deduction 2025 Hanny Kirstin, This section also discusses the. The standard deduction is tied to inflation, so the amounts change a bit each year.

IRS Standard Deduction 2025, Standard Deduction Calculator, If you can be claimed as a dependent by another taxpayer, your 2025 standard deduction is limited to the greater of $1,250. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of.